For a stunning 16 straight years, the Investor Advisory Service stock newsletter has been named to the annual Hulbert Investment Newsletter Honor Roll, the leading scorecard of stock newsletter ratings. No other newsletter has been on the Honor Roll for as many years as the IAS, and only one other newsletter appears on the 2025-26 Honor Roll.

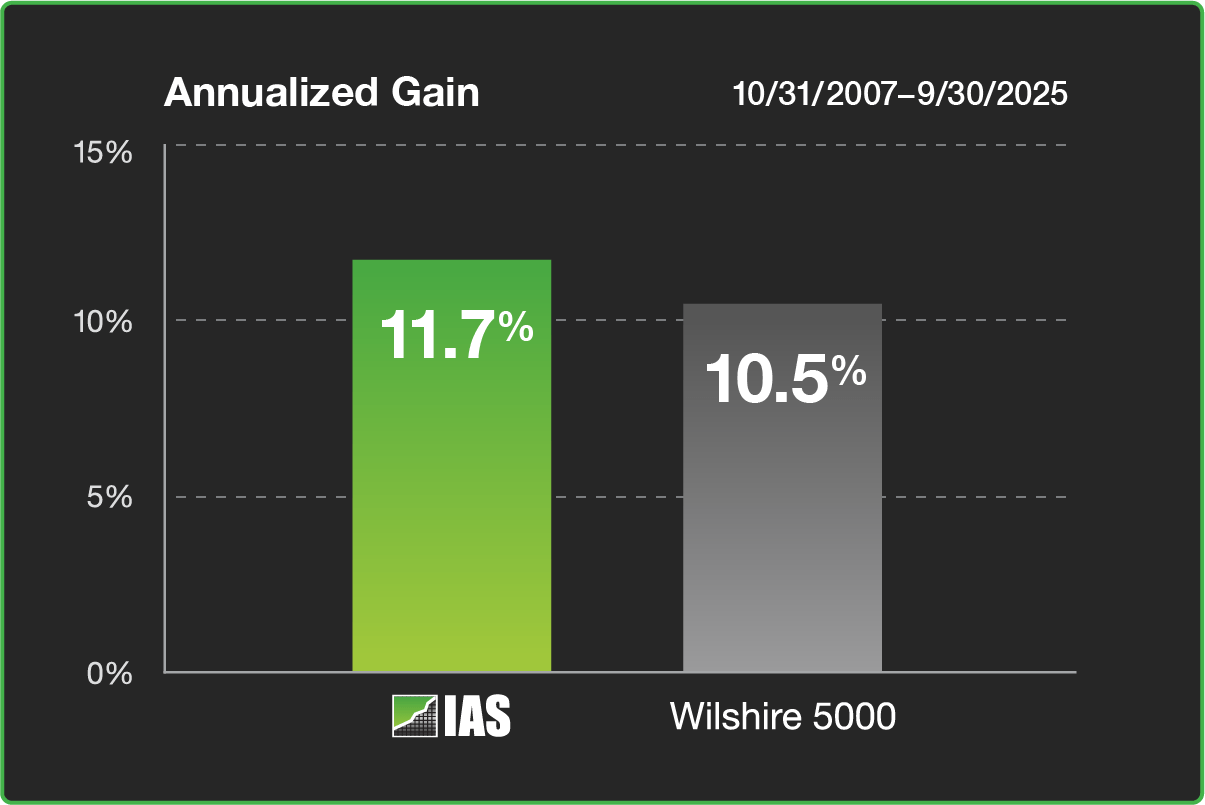

In order to be included on the Honor Roll, a fund or stock newsletter must exhibit above-average performance in both up and down markets over the long-term. For the 18-year period of the Honor Roll, the Investor Advisory Service stock picks gained an annualized 11.7% compared to 10.5% for the Wilshire 5000.

According to Mark Hulbert, “The most important reason to pay attention to the Newsletter Honor Roll, in my opinion: It helps you steer clear of particularly risky services that, even though they may produce stellar long-term returns, require more intestinal fortitude to follow than most investors possess.”

When it comes to providing greater returns than the market during both bull and bear cycles, few newsletters can match the Investor Advisory Service record.

There are scant few stock newsletters that score as well in stock newsletter ratings as the Investor Advisory Service. Download a sample issue and check out our special offer or subscribe today!